2022 hasn’t been the best of years for FTSE 100 stock Coca-Cola Hellenic Bottling Company (LSE: CCH).

War in Ukraine has caused massive operational issues in the region. It has also forced the business to withdraw from Russia, a core growth market. The firm had to take a €190m hit in the first half because of it.

More colossal charges could come down the line as the conflict drags on. But despite this threat I plan to continue holding my Coca-Cola HBC shares.

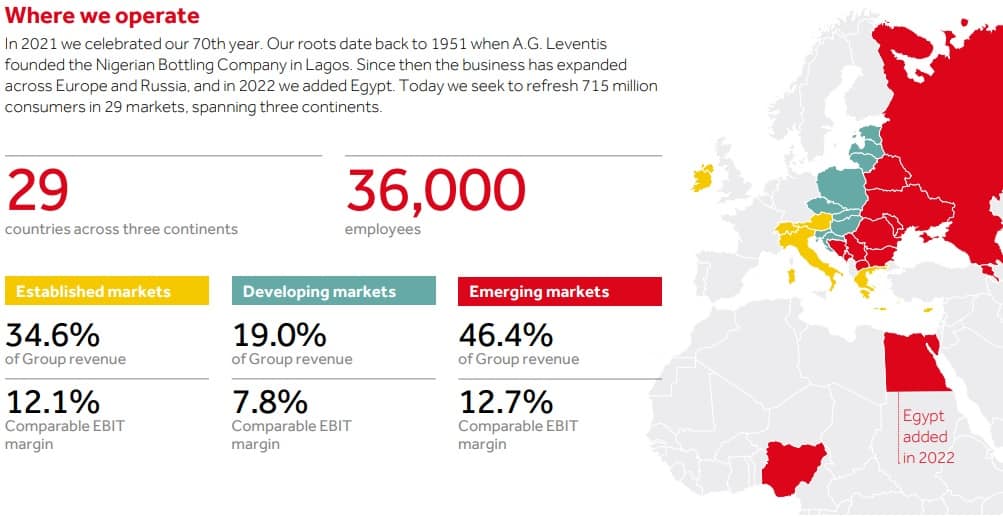

You see the business still has considerable exposure to exciting growth markets in Africa and across Central and Eastern Europe. And this could deliver tantalising investor returns in the decades ahead.

Brand power

Coca-Cola HBC has another formidable tool that makes it a great stock to buy. The products it bottles are some of the most popular fast-moving consumer goods on the planet.

This gives the FTSE 100 firm supreme earnings visibility, and the means, to maintain a broadly progressive dividend policy (more on this later).

Coca-Cola is the world’s most popular soft drinks brand, as the chart below from consultancy Brand Finance shows. In fact it’s worth more than twice as much as second-placed Pepsi.

And Coca-Cola HBC has more than just one superbrand in its locker. It can also rely on labels like Monster Energy, Fanta and Sprite to drive the bottom line.

Robust results

These drinks remain popular throughout the year and during all points of the economic cycle. Shoppers will stretch their budgets to buy them even when times get tough. I think they’ll go without other food and drink items to put them in their basket.

Furthermore, the immense brand power of Coke and the others means that prices can also be raised without demand collapsing.

Financials for the first half illustrate Coca-Cola HBC’s robustness. Even as the global cost-of-living crisis worsened and sales in Russia and Ukraine tanked, group organic revenues soared 19.4% year on year.

A passive income star

| Coca-Cola HBC share price | £20.40 |

| Price movement in 2022 | -21% |

| Market cap | £7.3bn |

| Forward price-to-earnings (P/E) ratio | 18.5 times |

| Forward dividend yield | 2.6% |

| Dividend cover | 2.1 times |

The company isn’t immune to bumps in the road. It saw earnings drop in 2020 as Covid-19 lockdowns smashed the hospitality sector. And it’s expected to see profits drop 13% this year too.

This means the business is expected to reduce the dividend too. A payout of 66 US cents per share is anticipated, down from 71 cents in 2021.

As an investor in the firm myself, I find this disappointing. However, my belief in Coca-Cola HBC as a great dividend stock remains undimmed. It’s certainly proved an effective share to boost my passive income in recent years.

Thanks to the qualities I describe above, the annual dividend payment here rose 109% between 2013 and 2021. And once the turbulence it’s experiencing in Russia and Eastern Europe abates, I expect the company’s progressive dividend policy to return. And so do City analysts who forecast a 73-cent dividend for 2023.